131 | Add to Reading ListSource URL: www.cargosupport.gov.auLanguage: English - Date: 2014-07-31 21:45:05

|

|---|

132 | Add to Reading ListSource URL: www.src.gov.scLanguage: English - Date: 2009-10-05 06:14:02

|

|---|

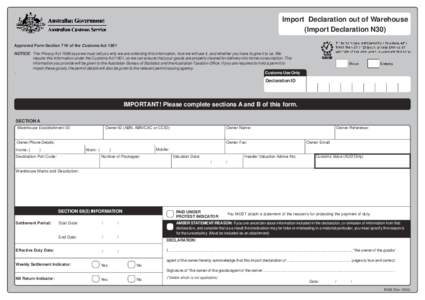

133 | Add to Reading ListSource URL: customs.gov.auLanguage: English - Date: 2012-10-23 21:33:04

|

|---|

134![l AWOTE adjustments on tobacco products – operative on and from 1 September 2014 The ABS released the June Quarter 2014 adult average weekly ordinary time earnings (AWOTE) amount on 14 August[removed]In accordance with l AWOTE adjustments on tobacco products – operative on and from 1 September 2014 The ABS released the June Quarter 2014 adult average weekly ordinary time earnings (AWOTE) amount on 14 August[removed]In accordance with](https://www.pdfsearch.io/img/69d76078dccff4842ce0ec5b4f717c14.jpg) | Add to Reading ListSource URL: customs.gov.auLanguage: English - Date: 2014-08-14 00:56:16

|

|---|

135 | Add to Reading ListSource URL: www.cargosupport.gov.auLanguage: English - Date: 2007-02-06 00:24:30

|

|---|

136![CONSOLIDATED TO 1 DECEMBER 2014 LAWS OF SEYCHELLES CUSTOMS MANAGEMENT ACT [2nd July, 2012] Act 22 of 2011 S.I. 43 of 2012 CONSOLIDATED TO 1 DECEMBER 2014 LAWS OF SEYCHELLES CUSTOMS MANAGEMENT ACT [2nd July, 2012] Act 22 of 2011 S.I. 43 of 2012](https://www.pdfsearch.io/img/f24a1339e03c6837df75b6d1afadf912.jpg) | Add to Reading ListSource URL: zoupio.lexum.comLanguage: English |

|---|

137![AUSTRALIAN CUSTOMS NOTICE NO[removed]Customs Tariff Amendment (Aviation Fuel) Act 2010 In May 2010, the Government announced an increase in customs duty rates and excise on aviation fuels. The Customs Tariff Amendment ( AUSTRALIAN CUSTOMS NOTICE NO[removed]Customs Tariff Amendment (Aviation Fuel) Act 2010 In May 2010, the Government announced an increase in customs duty rates and excise on aviation fuels. The Customs Tariff Amendment (](https://www.pdfsearch.io/img/0cf1ea587a1d564510d7c3ddab2a38d0.jpg) | Add to Reading ListSource URL: www.customs.gov.auLanguage: English - Date: 2010-07-01 01:47:31

|

|---|

138![AUSTRALIAN CUSTOMS NOTICE NO[removed]Customs Tariff Amendment (Aviation Fuel) Act 2010 In May 2010, the Government announced an increase in customs duty rates and excise on aviation fuels. The Customs Tariff Amendment ( AUSTRALIAN CUSTOMS NOTICE NO[removed]Customs Tariff Amendment (Aviation Fuel) Act 2010 In May 2010, the Government announced an increase in customs duty rates and excise on aviation fuels. The Customs Tariff Amendment (](https://www.pdfsearch.io/img/a66c293d2311927ee119d5cd177fd085.jpg) | Add to Reading ListSource URL: customs.gov.auLanguage: English - Date: 2010-07-01 01:47:31

|

|---|

139![Customs Notice (No[removed] – increases in the rates of duty for tobacco products – operative on and from 30 April 2010 The Government announced today (29 April[removed]increases in the excise and excise-equivalent rat Customs Notice (No[removed] – increases in the rates of duty for tobacco products – operative on and from 30 April 2010 The Government announced today (29 April[removed]increases in the excise and excise-equivalent rat](https://www.pdfsearch.io/img/796ac5bffd057739dbd9ce4d63bab777.jpg) | Add to Reading ListSource URL: customs.gov.auLanguage: English - Date: 2010-04-29 01:02:44

|

|---|

140 | Add to Reading ListSource URL: www.customs.gov.auLanguage: English - Date: 2010-04-29 01:02:44

|

|---|